Dalton Dellsperger

From the Field

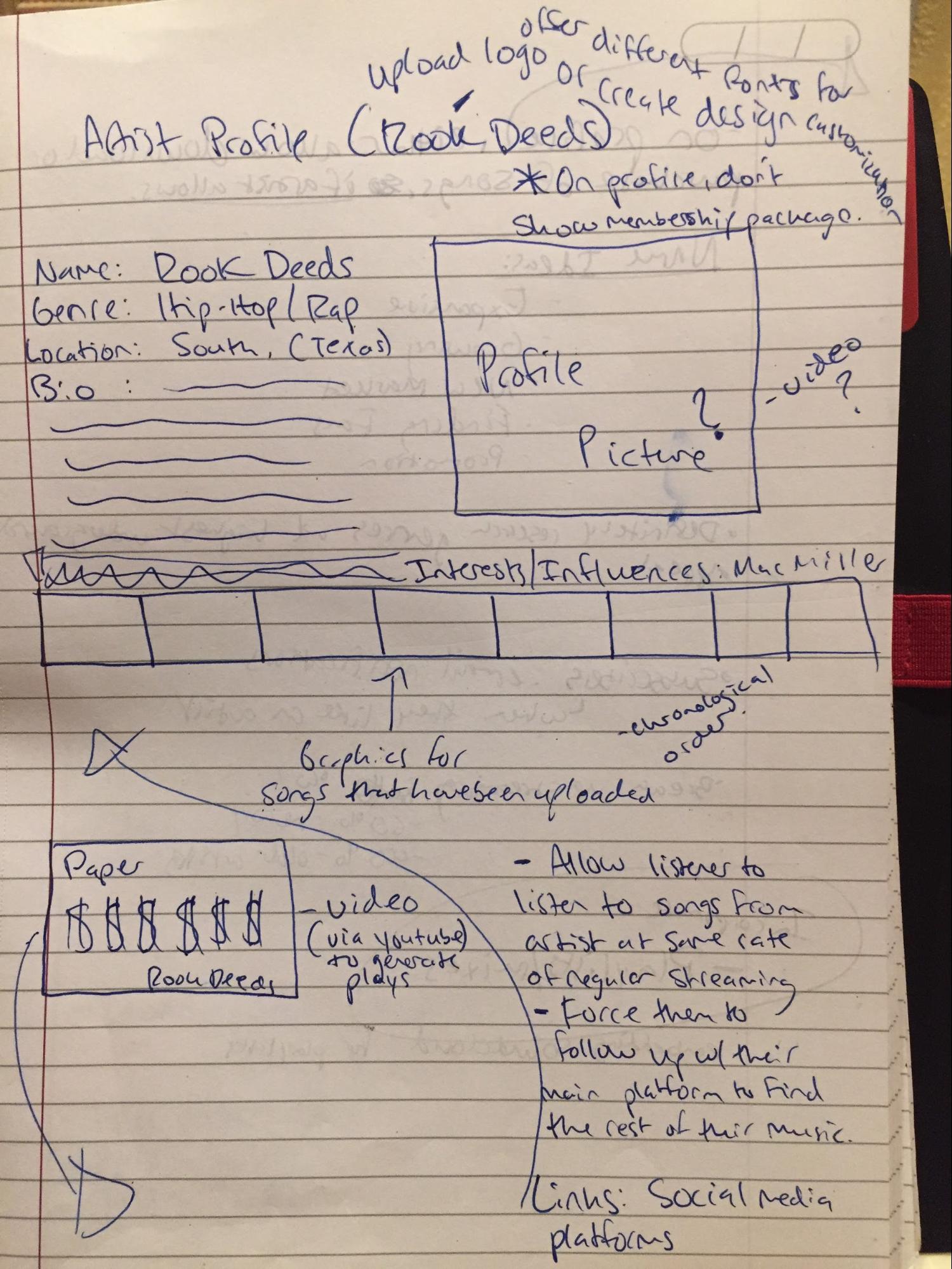

When I first had the idea of what would be our company, TownWave,[1] I never imagined I would have to break it down into such detail that would eventually match up with a traditional business model. We started with a lean startup canvas model, as most startups do, and expanded it from there.

My team’s biggest struggle was identifying our value proposition. As a “web-based artist/music discovery platform,” we were going into an oversaturated market of social sound platforms that all ideally promised the same thing for their customers. We had to differentiate ourselves in our business model canvas from the start to ensure we would not make the same mistakes as our competitors.

At the same time, we had to make sure we were identifying our market properly and knew how we would eventually pitch ourselves to a board of investors. Once we found an interested investor, my partner and I started to create a detailed business plan, filled with information and research from our potential customer market. Some of the information gathered included amount of time people spent searching to discover new music, their preferred platform for music discovery, and the average amount of time listeners spent listening to music each day.

Finding data and information that proved there was a need for our product in the industry was the most important part for our investor. Investors don’t care how much a company believes in its projected success, you must provide them with numbers that back up your claim and give the investor confidence they are investing in something special.

We had to conduct our own polls and research studies to prove that there was a massive market of opportunity for our company to thrive in. Our business plan is single-handedly the most important document we have ever worked on. It’s roughly 30 pages of one single idea, TownWave, broken down into claims that our product will deliver on its promise, which is all backed by research. We were offered $200,000 for 33% equity in our company from an angel investor and though this was exciting news for us, we eventually turned down the offer and continued with our app’s development. We felt giving away such a high percentage of our company that early in our company’s development was not right for TownWave’s future success. Since then, we have been developing our product into something much greater and have since been offered multiple investments of $100,000 for 10% equity, which valuates our company much higher than the original offer would have. We are now in the process of releasing our finished product into the market and using SAFE agreements [“simple agreements for future equity”] to lock down a few investors to help us push our product into the hands of millions of listeners and artists.

Dalton Dellsperger graduated from Texas Tech in May 2017. He is now working full time on his entrepreneurial venture, TownWave. Reach him on Twitter at @dalton_townwave.

Leave feedback on this sidebar.

- TownWave, http://townwave.com/. ↵