4 The Business of Healthcare

Jessica Hertig

Learning Objectives

- Categorize the different payment models for different levels of care.

- Distinguish between different insurance coverages.

- Discuss the benefits of understanding payment methods and models.

- Identify professional behaviors for off-unit activities or experiences.

- Briefly identify some of the non-traditional nursing roles that exist away from the bedside.

The Business of Healthcare

Many nurses enter the healthcare field because they want to help their patients stay healthy and/or ease their patients’ acute and chronic conditions. Nurses are not typically driven by a desire to manage healthcare billing, understand health insurance, or function in an administrative role. However, as long as health insurance and the financial costs of healthcare affect our patients, nurses need to understand their role in managing these costs. Financial well-being can be directly affected by costs associated with maintaining health or treating acute or chronic conditions. A patient’s health can also be impacted by the stress of unpaid bills, direct costs associated with healthcare, indirect costs such as missed work, rising insurance premiums, and the impact these costs have on their family and dependents.

The nursing field contains a variety of roles and responsibilities, something that is often an attractive aspect of the field for nursing students. As nurses develop their expertise in a certain field or specialty, they are often able to climb up the career ladder and assume more responsibility, which can often include formal and informal leadership or management opportunities.

From the time of Florence Nightingale in the 1800s until today, nurses have been the largest workforce in healthcare organizations. In the past, their role was limited to the bedside, but through the work of nursing leaders, nurses now have a voice in the administration and management of healthcare. Nurses have welcomed the opportunity to participate in the creation of budgets and policies to support the care of their patients and the workplace for their peers.

Nursing students and nurses spend a lot of time perfecting their communication skills, their assessment skills, and their clinical skills, but few are given the opportunity or resources to learn about the business side of the field to which they are committing their professional lives. The content and tools in this chapter are intended to provide RN to BSN students with the knowledge to understand their chosen field and how best to provide cost-effective care for their patients.

How Is Care Paid For?

Healthcare payment models are dictated by a variety of factors including the Social Security Act, Diagnosis-Related Groups (DRGs), Healthcare Common Procedures Coding System (HCPCS) codes, and negotiated contracts. The type of setting where care is delivered may affect which payment model is used. Most of all, charging, billing, and reconciling budgets happen “behind the scenes” and away from staff involved in patient care, but the actions and documentation of those performing that hands-on care can greatly influence the amount reimbursed for care delivered .

The United States does not have a system of universal healthcare like other countries such as Canada and Great Britain. This adds greatly to the complexity of healthcare finance. There are three major ways that patients present to the healthcare organization: with government-based insurance (e.g., Medicare-type programs, VA, Affordable Care Act, or government employees and retirees), with private insurance (either through an employer or individually purchased), and without insurance (or uninsured). Some patients may have a combination of coverage (such as a policy to supplement Medicare), or they may have insurance but not be covered (or be uninsured) for some conditions or situations.

The U.S. government pays for about 50% of all healthcare billed in the United States (Kaiser Family Foundation, 2019). Frequently, but not always, when the government makes a change in reimbursement policy, it is quickly followed by a change in the reimbursement policy of private insurers.

Inpatient Prospective Payment System (IPPS)

The federal government defines a system of payment for the costs of acute care hospital inpatient stays under Medicare Part A in Section 1886(d) of the Social Security Act (Centers for Medicare & Medicaid Services [CMS], 2020). This system is called the inpatient prospective payment system (IPPS). The IPPS is based on prospectively set rates, or the expected cost to care for a patient (CMS, 2020). Under the IPPS, each case is categorized into a DRG (CMS, 2020). Each DRG has a payment weight assigned to it based on the average resources used to treat Medicare patients in that DRG (CMS, 2020). Additional payments can be made to inpatient facilities that meet certain conditions, such as facilities with high labor costs (due to higher costs of living in their geographical areas); facilities that care for a high percentage of low-income patients; and/or facilities that qualify as teaching hospitals, which are eligible for add-on payments to their assigned DRGs (CMS, 2020). IPPS payments may also be penalized for not meeting specific quality benchmarks, such as 30-day readmissions.

Hospitals employ teams of professionals skilled in translating the patient’s record into a DRG that accurately captures the reason for the patient’s hospitalization while maximizing the payment the facility is eligible for. These professionals work off strict guidelines indicating required documentation to determine eligible charges for certain DRGs. There is often communication between all members of the care team to ensure that the documentation accurately reflects the patient’s health, diagnoses, and comorbidities. Without accurate and complete documentation, hospitals are unable to charge for all of the care being delivered.

As an experienced nurse at her facility, Roxanne has developed trusting relationships with many of the residents and their families. Roxanne was glad to see that long-time resident, Mr. Butler, recently returned from a long hospital stay. Mr. Butler relies on his son, Sam, to help manage his finances. Sam received a bill from the hospital and a statement from Roxanne’s facility. Sam visits during Roxanne’s shift and tries to explain the costs to his dad, but they are both visibly frustrated and confused. Sam asks if Roxanne can help make any sense of the charges, costs, and statements they’ve received.

As an experienced nurse at her facility, Roxanne has developed trusting relationships with many of the residents and their families. Roxanne was glad to see that long-time resident, Mr. Butler, recently returned from a long hospital stay. Mr. Butler relies on his son, Sam, to help manage his finances. Sam received a bill from the hospital and a statement from Roxanne’s facility. Sam visits during Roxanne’s shift and tries to explain the costs to his dad, but they are both visibly frustrated and confused. Sam asks if Roxanne can help make any sense of the charges, costs, and statements they’ve received.

As a BSN-prepared RN, Roxanne could respond to Sam with information about how the hospital stay is billed: based on expected costs to care for a patient with Mr. Butler’s diagnosis and adjusted based on his other conditions and other factors that affect the hospital. If Roxanne wanted to point Sam towards some resources that could help him understand the billing process a bit better, she could give him the following: www.cms.gov, https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/AcuteInpatientPPS, or https://www.aha.org/system/files/2018-01/factsheet-hospital-billing-explained-9-2017.pdf.

Outpatient Prospective Payment System (OPPS)

With more and more care and procedures being done outside of the hospital setting, a separate payment system was created in 2000 (American Hospital Association [AHA], n.d.). Similar to the IPPS, the outpatient prospective payment system (OPPS) is based on the prospective, or expected, costs of a procedure and can be adjusted for a variety of factors, including labor costs, geographic location, etc. (AHA, n.d.). Outpatient procedures are coded, but not according to diagnosis like in the IPPS. The OPPS is based on the Healthcare Common Procedure Coding System (HCPCS) code (AHA, n.d.). Some changes have been made to the OPPS so that procedures are covered under the physician’s billing system (AHA, n.d.). Federal law continues to evolve on how procedures are billed and paid for.

Recently, Roxanne worked with the care team to get a portable chest X-ray for Mrs. Garcia. Luckily, the X-ray showed no serious health problems, but Mrs. Garcia had questions about the bill she received for the test. Mrs. Garcia asks Roxanne, as her nurse, to explain some of the charges.

Roxanne can base her explanation on her understanding of the complex OPPS. Outpatient procedures are assigned an HCPCS code, which has a predetermined cost associated with it as set by the CMS . Roxanne could provide Mrs. Garcia with some additional resources, including https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/HospitalOutpatientPPS or https://www.aha.org/advocacy/current-emerging-payment-models/outpatient-pps#:~:text=The%20OPPS%20sets%20payments%20for,geographic%20differences%20in%20input%20prices.&text=The%20unit%20of%20payment%20under,Coding%20System%20(HCPCS)%20codes.

Insurance Coverage

The vast majority of Americans, 89.1%, are covered by some type of health insurance (Tolbert et al., 2020). The many different insurances fit into one of two categories: private or public. While all insurances involve at least some out-of-pocket costs to the consumer, those with public insurance (like Medicare or Medicaid) share those costs with either the state or federal government. The past decade has seen an ongoing debate over the role of health insurance, the role of the government in health insurance, and if insurance is helpful. In Sommers et al. (2017), the authors synthesized a number of studies on the effects of health insurance on a variety of factors and found that the benefits of having insurance extend to those with private or public insurance in terms of access to care and treatments received. Knowing the differences in coverage can help RNs be a resource to patients with questions about their financial responsibilities related to their care.

Medicare

Medicare coverage was enacted in 1965 to provide coverage for adults over the age of 65, adults younger than 65 with certain disabilities, and adults with end-stage renal disease (ESRD) on dialysis (CMS, 2021). Medicare covers different types of care under its different parts. Patients may have different combinations of parts of Medicare depending on their individual situation.

| Part A |

| Adults who pay Medicare taxes through their paychecks are eligible for Part A at the age of 65 for little to no premium (CMS, 2021). Part A pays for services received in the acute/inpatient care setting (CMS, 2021). Examples include hospital or inpatient hospice stays. |

| Part B |

| Part B coverage is available for a monthly premium. The standard premium for this coverage in 2022 was $170.10 per month (CMS, n.d.-a). Part B pays for outpatient and clinic or doctor’s office services (CMS, 2021). Patients in the hospital receiving Observation services are covered under Part B and are subject to Part B deductibles and copays (CMS, 2021). |

| Part C |

| Part C coverage is available for a monthly premium that varies by plan (CMS, 2021). Part C coverage is through a commercial/private insurance company that supplements standard Medicare coverage. Many patients hear about Part C plans through commercials on television from companies such as United Healthcare, AARP, and Humana. |

| Part D |

| Part D coverage is available for a monthly premium (CMS, 2021). There are numerous Part D plans with variable coverage and premium costs. Part D covers any prescription drug costs (CMS, 2021). |

Two of Roxanne’s residents recently received services: Mr. Butler was in the hospital and Mrs. Garcia received a portable chest X-ray. Both have Medicare coverage. Roxanne has been asked to explain how each resident’s care is covered and what the resident is responsible for paying.

Based on her knowledge of Medicare coverage, Roxanne could help Mr. Butler understand that his hospital stay is covered under Part A. There is an associated deductible and coinsurance of $1,556 per benefit period (CMS, n.d.-a). Mrs. Garcia’s X-ray would be covered under Part B, which has a deductible of $233 (CMS, n.d.-a). A helpful resource that Roxanne could share with her residents to help answer their questions about Medicare coverage is https://www.medicare.gov/your-medicare-costs/medicare-costs-at-a-glance.

Medicaid

As of July 2021, 76.7 million people were covered by Medicaid (CMS , 2022). This number includes low-income adults, children, pregnant women, elderly adults, and adults with disabilities (CMS, 2022). While the federal government contributes to the funding of this program as well as establishing certain standards, the Medicaid program is administered by the state (CMS, 2022). Examples of Medicaid programs available in Wisconsin include BadgerCare Plus (low-income adults and children), Family Care (long-term care for disabled adults), PACE (long-term care services provided to disabled adults in their own homes), and Wisconsin Well Woman (which provides pre-cancer screenings for women) (Wisconsin Department of Health Services, 2019).

Out-of-pocket costs for Medicaid patients vary by service, program, and state. Traditionally, because Medicaid is intended for sick and low-income patients, out-of-pocket costs are nominal (CMS, 2022). The federal government has also mandated that certain services, such as emergency services, family planning, pregnancy-related services, and preventive services for children, cannot have out-of-pocket costs associated with them (CMS, 2022). Examples of out-of-pocket costs from 2013 include $4-$8 for a prescription, $8 for a non-emergency emergency room visit, and $75 for an inpatient hospital stay (note these values are affected by the patient’s income level and state of residence) (CMS, 2022).

Based on her knowledge of Medicaid coverage, Roxanne could help Mr. Butler and Mrs. Garcia understand that both services will be covered under their plan and that there should be minimal out-of-pocket costs associated with each service. A helpful resource Roxanne can share with her residents is available at https://www.dhs.wisconsin.gov/badgercareplus/services.htm.

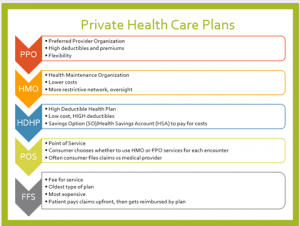

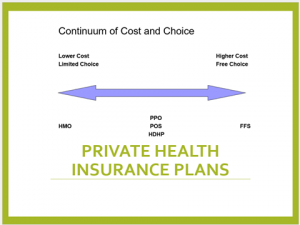

Private Insurance

The United States spends more money per capita than any other country on healthcare, and the largest portion of that spending goes to private health insurance companies (Peter G. Peterson Foundation, 2020; CMS , n.d.-c). In 2020, private insurance companies collectively brought in $31 billion in profits (National Association of Insurance Commissioners, 2021). While different insurance companies may cover different things or charge different prices, the plans they offer all fall into one of the following five plan types.

Based on Roxanne’s knowledge of private health insurance, she would recommend a high-deductible health plan (HDHP) for Linda. The cost of the plan is a factor for Linda since she is starting a new business. With a high-deductible plan, Linda can still have access to her provider for her regular physical. She can also have access to some coverage should she be struck by a sudden illness. Linda’s husband, however, may want to look at an HMO (Health Maintenance Organization) or PPO (Preferred Provider Organization) option. The HMO would be lower cost, but his trusted provider may not be covered depending on the plan/network. If Linda’s husband wants to stay with his current provider and is able to cover some higher deductibles and premiums, a PPO plan may be the right fit. Roxanne can ask Linda to review the resources available at https://finder.healthcare.gov/ for more information. Roxanne can also direct Linda to the facility’s case manager or social worker to help answer specific questions.

Marketplace

In 2010, the Patient Protection and Affordable Care Act (commonly called the Affordable Care Act, ACA, or “Obamacare”) was passed and signed into law (U.S. Department of Health and Human Services, 2021). This video discusses some of the highlights of that law:

The ACA created a marketplace of private insurance companies offering coverage to people who otherwise did not have access to coverage or who could not afford coverage. Individuals purchasing a plan through the marketplace can choose from one of four “metal” categories: bronze, silver, gold, or platinum (CMS , n.d.-d). The different categories determine how the consumer and the plan split costs, not the quality of care the consumer receives (CMS, n.d.-d). Plan premiums may also be adjusted based on the consumer’s income (CMS, n.d.-d).

Roxanne has already considered and discussed Linda’s private insurance options with her, but Roxanne realizes there may be other options available on the marketplace. Roxanne uses her knowledge of the ACA and the marketplace to recommend to Linda that she may want to consider a bronze-level plan, as it would have low premiums and provide coverage in a worst-case scenario situation. On the other hand, Linda’s husband may want to consider a silver-, gold-, or even platinum-level plan based on his medical needs. He may also qualify for “extra” savings based on his income. Roxanne provides Linda with a website for more resources: https://www.healthcare.gov/choose-a-plan/plans-categories/.

Financial Assistance

As complex as the US health system is for consumers, there are a number of resources available to help patients cover the cost of the care they need. A common challenge for patients (and nurses trying to help those patients) is knowing where to find the assistance that is available. Hospital systems commonly have entire departments that assist patients with financial assistance, social workers are a common role in the inpatient, outpatient, and community settings as well. Additionally, these are a few resources nurses can share with patients as needed.

National Consumer Law Center Review of Hospital Financial Assistance Policies: https://www.nclc.org/images/pdf/medical-debt/report-ounce-of-prevention-jan2020.pdf

How to Find and Use Financial Assistance Programs from GoodRX: https://www.goodrx.com/insurance/health-insurance/medical-financial-assistance-programs

What to know about Hospital Financial Assistance Policies by US News and World Report: https://money.usnews.com/money/personal-finance/spending/articles/what-to-know-about-hospital-financial-assistance-policies

Bedside to the Boardroom

Nursing is a dynamic profession that allows for countless professional experiences at and away from the bedside. While nursing school provides much of the clinical education that nurses need to care for patients, students are often less prepared to assume leadership roles. There are important skills and etiquette tips that can strengthen a nurse’s presence and contribution to the desired outcome, no matter their role.

Elevator Pitch

Have you ever found yourself alone in an elevator with a high-ranking official at your facility? Maybe your boss’s boss? Or the president of the hospital? A prestigious physician? Being prepared with an elevator pitch can be the key to avoiding the silent and often awkward ride between floors. Your introduction can serve as self-promotion or an endorsement of a new policy; you might also share a quick idea or pitch. Here are a few tips:

- Be confident when you introduce yourself.

- Make eye contact.

- Share an accomplishment you or your team have achieved.

- Share a business card (if you have one).

- Keep the “pitch” to 15 seconds or less; even if the ride isn’t over yet, it will give your audience a chance to respond to you.

- Avoid cornering your audience with demands or complaints (this is not the appropriate setting), but this introduction can establish a relationship that might make your audience more likely to listen to your concerns in another venue.

“Hello, Ms. Hopkins! My name is Roxanne. I’m a nurse on 4 West. I just wanted to introduce myself and let you know that I am the new skin-assessment champion on the day shift. I’m hopeful we can help our patients avoid pressure ulcers; our data is already improving!”

Professional Attire

Whether caring for patients at the bedside or advocating for resources in the boardroom, how nurses represent themselves is important. The commonly perceived “uniform” of a bedside nurse is scrubs. This attire is much more informal than a suit and briefcase, but it can still portray professionalism to patients, colleagues, and superiors. “Does a nurse dressed in bunny-print scrubs establish immediate trust, authority, and credibility” (Pagana, 2019, p. 85)? Consider your patient population, care setting, and facility dress codes when choosing your attire for your next shift.

Nurses in any role may be asked to join a workgroup, committee, or board that requires meeting outside of regular shifts. It is often helpful to look at the leaders of the group you are joining to determine the most appropriate attire. Note that some leaders (e.g., educators, department managers) may dress differently than the executives in the group, so you might consider dressing for the role you aspire to (Pagana, 2019). Business casual is a style that is often acceptable in many workplaces but has ambiguous definitions depending on the setting. Commonly, business casual is more relaxed while still being professional and acceptable (Headen, 2022). The acceptable parameters for business casual within a specific organization are typically detailed in the employee handbook. Jeans, or denim of any kind, are typically considered too casual for business casual.

A Note About Appearing Professional Online

The COVID-19 pandemic has changed the way a lot of business interactions happen, moving many meetings, discussions, and interviews online. When participating in an online meeting, it’s important to maintain the same standard of professionalism (including attire) that you would in person. Developing professional relationships virtually can be challenging; however, keeping your video on and your face turned toward the camera may help. Making “virtual eye contact” with someone can develop the trust and collegiality needed to meet your desired outcomes, but this means your appearance must portray professionalism as well.

Take the time to do an “online presence audit” on yourself. Review your social media spaces and search for your name in Google. Consider how the results of your review would be received by a potential employer, mentor, or even patient/patient’s family member.

Visit the ANA’s Social Media Principles page and use their suggestions to improve your online presence and professionalism: https://www.nursingworld.org/social/.

Roxanne comes in to work for her first workgroup meeting dressed in plain black pants and a collared button-up shirt. Her hair is clean and styled simply with basic makeup and jewelry. Roxanne wears her ID badge on her chest at heart level. At the end of the first meeting, Roxanne learns that the next meeting will be virtual. When the next meeting begins, Roxanne is ready at her computer with her camera on wearing similar attire. Roxanne feels that she is earning respect from the other workgroup members based on her professionalism, eye contact, and collaboration.

Meetings

Even with so much business being conducted virtually since 2020, in-person meetings still occur in many healthcare settings. While individual facility and/or setting policies may dictate the procedures of holding a meeting, some commonly accepted standards will likely apply. Whether attending a meeting as the planner/coordinator or a participant, nurses can portray their professionalism in a boardroom setting as well as at the bedside.

Chairperson

The chair, or head of a group of people with a common goal, sets the tone for the project and each meeting. If you serve as a chairperson, some useful tips for leading a meeting include:

- Preparing and distributing an agenda to the meeting participants in advance.

- Guiding the meeting discussion to follow the agenda while preventing unproductive tangents.

- Arriving early to greet team members.

- Managing or delegating management of meeting tasks (including minutes, timekeeping, etc.).

- Encouraging and promoting equal participation among the team members.

- Summarizing the discussion at the end of the meeting along with any assignments.

Roxanne starts preparing the agenda for the next meeting. She’d like to begin with a report from each discipline, so she reaches out to attendees to be included on the agenda. On the day of the meeting, Roxanne arrives early and is feeling confident but a bit anxious. She discusses the agenda items with all of the team members and provides a summary of the most recent facility-wide meeting. Roxanne seeks input from her team on how they can improve their numbers as they are not meeting their targets. At the end of the meeting, Roxanne confirms the date and time for the next meeting with the team and summarizes the discussion and action items discussed. At the end of the meeting, Roxanne feels empowered and relieved.

Participant

While participating in a meeting may appear to be less work than chairing it, meeting participants have specific responsibilities that are equally as important. The chairperson is responsible for holding the participants to these responsibilities, which include:

- Actively participating in emails, meetings, and action items.

- Coming to meetings prepared with the required tools.

- Allowing others a chance to contribute to the discussion or work distribution.

- Maintaining communication with the chairperson or designee if the chairperson is unable to attend, complete a task, etc.

Roxanne approached the chairperson of the committee. She introduced herself, made eye contact, and projected confidence. Roxanne reminded the chair that this was her first meeting and asked if there was somewhere in particular where she should sit. The chair indicated where Roxanne could sit and said she would introduce all of the team members at the start of the meeting. Roxanne appreciated the gesture. It helped her put together the names and faces of the team members she didn’t know previously. This helped Roxanne feel confident and project professionalism during the meeting.

Virtual Meetings

Even prior to the 2020 pandemic (and certainly since then), virtual meetings have provided access for individuals that was not always possible with the traditional face-to-face format. Virtual meetings are seemingly less formal than in-person meetings, but professional standards still exist to keep interactions collegial and participants on-task.

When participating in a virtual meeting, you should do so in a private, quiet space. Minimize as many distractions and background noises (alarms, TV, pets, etc.) as possible. Familiarize yourself with the platform where your meeting will be conducted. If you are attending a meeting on a new platform, you might want to download any software beforehand and do a trial run before the first meeting whenever possible. Especially when using a new platform, logging on to a meeting 10-15 minutes before it begins is preferred. Once you are in the meeting, ask or follow your chairperson’s lead regarding if cameras or microphones should be turned on and when.

On meeting day, Roxanne spends the morning downloading and learning the software that will be the platform for her meeting. She had to call the help desk to gain access, so she’s glad she did this in advance. About 15 minutes before the meeting will begin, Roxanne logs on to the meeting and waits for her team to arrive. She greets the attendees one by one as they join. At the beginning of the meeting, Roxanne asks everyone to turn their cameras on, and she kicks off a brief conversation unrelated to the agenda to warm everyone up to the virtual setting. After that brief exercise, she notifies the attendees that they can turn their cameras on or off at their own discretion. Aside from a few reminders to mute a microphone when a participant is not engaged in a discussion, Roxanne is relieved to find that her team has adjusted well to this new format. She conducts the rest of the meeting as usual and closes with a thank you to her team for their flexibility.

Summary

The opportunity to take an active role in the governance of a healthcare organization is very rewarding. It is exciting that healthcare (and other) organizations are recognizing the value of having nursing representation in high administrative positions. Nurses can make a difference for their patients and their peers by serving in these roles.

References

American Hospital Association. (2017). Fact sheet: Hospital billing explained. https://www.aha.org/system/files/2018-01/factsheet-hospital-billing-explained-9-2017.pdf

Centers for Medicare & Medicaid Services. (n.d.-a). Medicare costs at a glance. Medicare.gov. https://www.medicare.gov/your-medicare-costs/medicare-costs-at-a-glance

Centers for Medicare & Medicaid Services. (n.d.-b). Part B costs. Medicare.gov. https://www.medicare.gov/your-medicare-costs/part-b-costs

Centers for Medicare & Medicaid Services. (n.d.-c). The nation’s health dollar: Where it went and where it came from. https://www.cms.gov/files/document/nations-health-dollar-where-it-came-where-it-went.pdf

Centers for Medicare & Medicaid Services. (n.d.-d). Things to know before picking a health insurance plan. HealthCare.Gov. https://www.healthcare.gov/choose-a-plan/comparing-plans/

Centers for Medicare & Medicaid Services. (2020, February 20). Acute inpatient PPS. https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/AcuteInpatientPPS

Centers for Medicare & Medicaid Services. (2021, December 1). Medicare program – General information. https://www.cms.gov/Medicare/Medicare-General-Information/MedicareGenInfo

Centers for Medicare & Medicaid Services. (2022). Medicaid.gov. Medicaid.Gov. https://www.medicaid.gov/

Headen, W. (2022, January 11). What does “business casual” mean? (With example outfits). Indeed Career Guide. https://www.indeed.com/career-advice/starting-new-job/guide-to-business-casual-attire

Kaiser Family Foundation. (2019, February 21). Government now pays for nearly 50 percent of health care spending, an increase driven by baby boomers shifting into Medicare. Kaiser Health News. https://khn.org/morning-breakout/government-now-pays-for-nearly-50-percent-of-health-care-spending-an-increase-driven-by-baby-boomers-shifting-into-medicare/

National Association of Insurance Commissioners. (2021). U.S. health insurance industry analysis report. https://content.naic.org/sites/default/files/inline-files/2020-Annual-Health-Insurance-Industry-Analysis-Report.pdf

Optum 360. (2020). National average payment table update. https://www.optum360coding.com/upload/docs/2021%20DRG_National%20Average%20Payment%20Table_Update.pdf

Pagana, K. D. (2019). Etiquette and communication strategies for nurses (3rd ed). Sigma Theta Tau International.

Peter G. Peterson Foundation. (2020, July 14). How does the U.S. healthcare system compare to other countries? https://www.pgpf.org/blog/2020/07/how-does-the-us-healthcare-system-compare-to-other-countries

Pollack, C. E., Griffin, B. A., & Lynch, J. (2010). Housing affordability and health among homeowners and renters. American Journal of Preventative Medicine, 39(6), 515–521.

Sommers, B. D., Gawande, A. A., & Baicker, K. (2017). Health insurance coverage and health—What the recent evidence tells us. New England Journal of Medicine, 377(6), 586–593. https://doi.org/10.1056/nejmsb1706645

Tolbert, J., Orgera, K., & Damico, A. (2020, November 13). Key facts about the uninsured population. Kaiser Family Foundation. https://www.kff.org/uninsured/issue-brief/key-facts-about-the-uninsured-population/

U.S. Department of Health and Human Services. (2021, March 23). 5 things about the Affordable Care Act (ACA) [Video]. YouTube. https://www.youtube.com/watch?v=j9tRVESzJ1M&t=20s

Wisconsin Department of Health Services. (2019, June). Medicaid in Wisconsin: A to Z (P-02383). https://www.dhs.wisconsin.gov/publications/p02383.pdf

classification system of diagnoses that are assigned weights that are used to determine payment for inpatient services.

classification system of procedure codes used to determine payment for outpatient procedures.

insurance coverage provided for adults over the age of 65, disabled adults, and/or adults with End Stage Renal Disease (ESRD); administered and funded through the federal government.

payment system for acute inpatient hospital stays by Medicare as defined by the Social Security Act.

payment system for outpatient procedures to cover the expected costs.

type of private insurance plan with very low premiums but very high deductibles; subscribers typically rely on a health savings account to cover costs when or if services are needed.

type of private insurance plan with a restrictive network of providers that is associated with lower costs to the consumer.

type of private insurance plan that provides for flexibility to see a variety of providers that is associated with high deductibles and premiums.

a type of private insurance plan provided by the Affordable Care Act that allows consumers to purchase health insurance with varying degrees of costs/coverage (bronze, silver, gold, platinum).

a short, planned introduction of yourself and your work to an upper-level executive that demonstrates your professionalism and contribution to the organization’s success.